Please note that our website uses cookies. To learn more about our cookies and how we use them, please read our Privacy Policy.

Swap financing

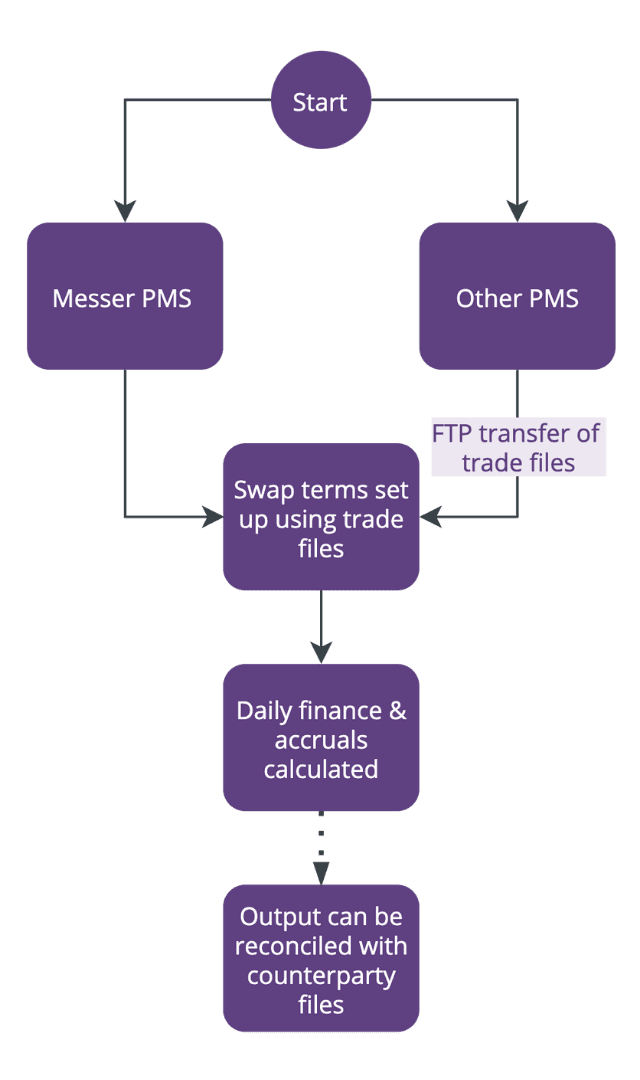

Programmatic solution to swap management

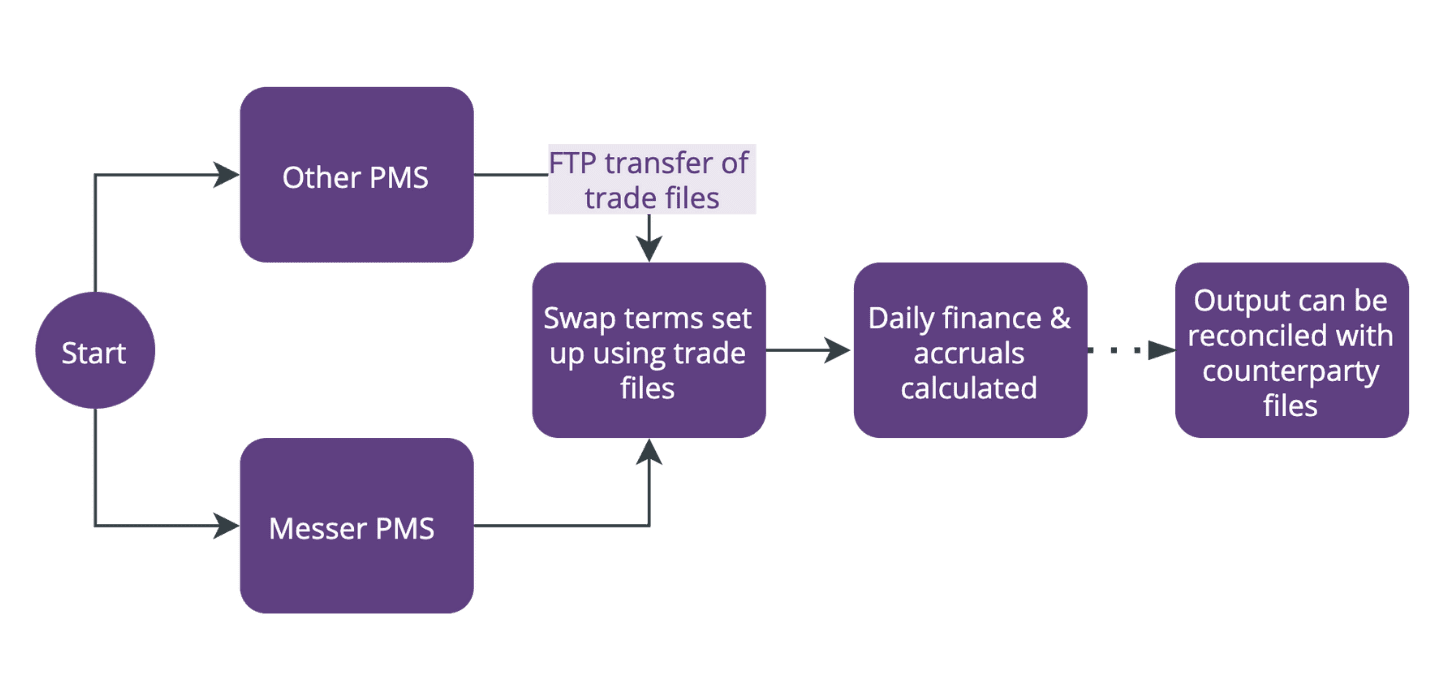

The swap finance module provides a complete programmatic solution to managing swap booking, lifecycle events and management of financing terms. The service integrates seamlessly with Messer’s reconciliation service. Be it compression workflow, swap dividend without pay date, or separating equity and financing legs in total swap valuation to accommodate nuances from using different counterparties, our module does it all. Automated accrual calculation is also a necessary step to set the foundation for reconciliation later.

This workflow is available as an add-on to Prodigy and as a standalone workflow.

How does it help?

Automated accrual calculation based on the client swap terms set up, to allow for automatic reconciliation later.

Use cases

Solve for misalignment in swap valuation between the client, client’s trading system and counterparties. Some examples of use cases we have handled include:

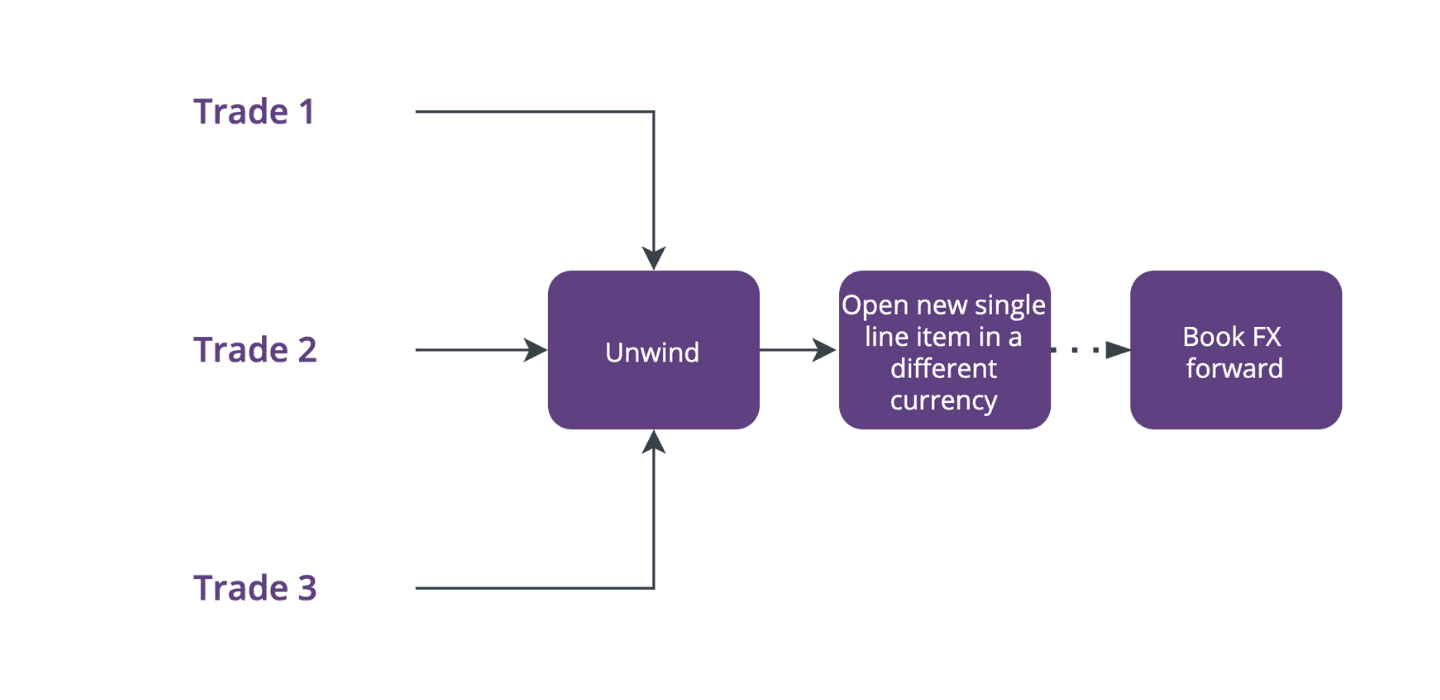

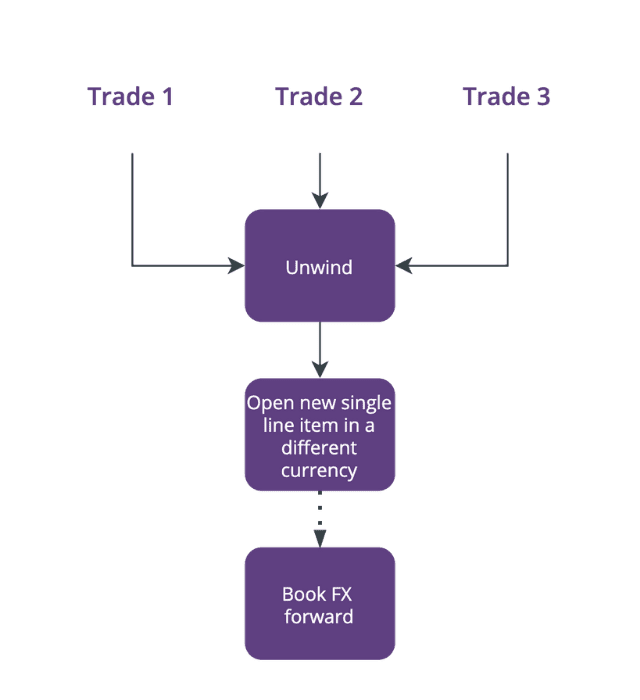

- Compression workflow

- Swap dividend with no pay date

- Separating equity and financing leg in total swap value for reconciliation

Key features

General

- Auto-import swap trades from counterparties

- Support setup and maintenance of financing templates

- Trade booking and amendment

- Daily accrual calculations

- Resets management

- Dividend workflow

- Rerate workflow

- Aggregated reporting

- Lot-based trades view showing opening, closing and resetting of swaps

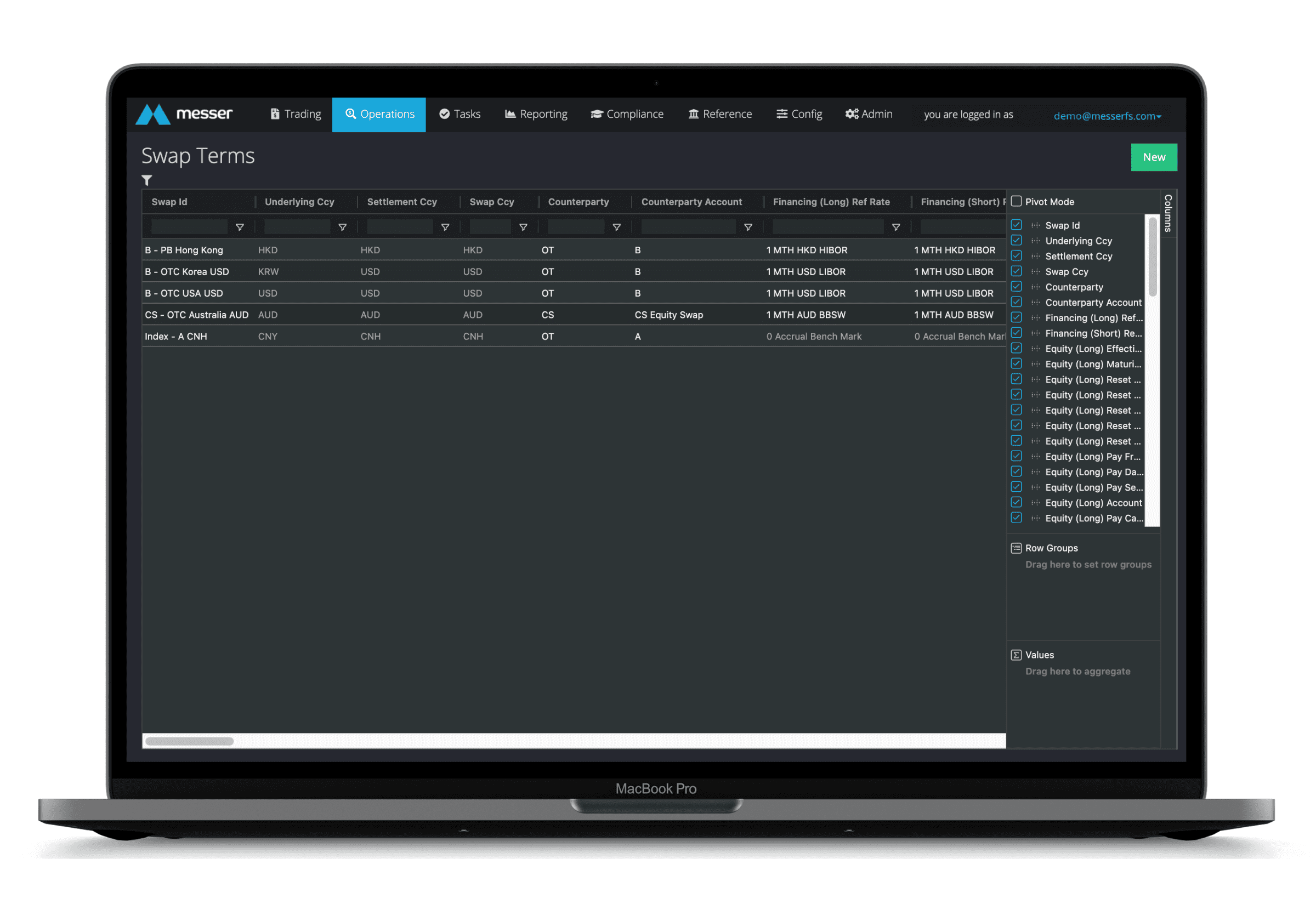

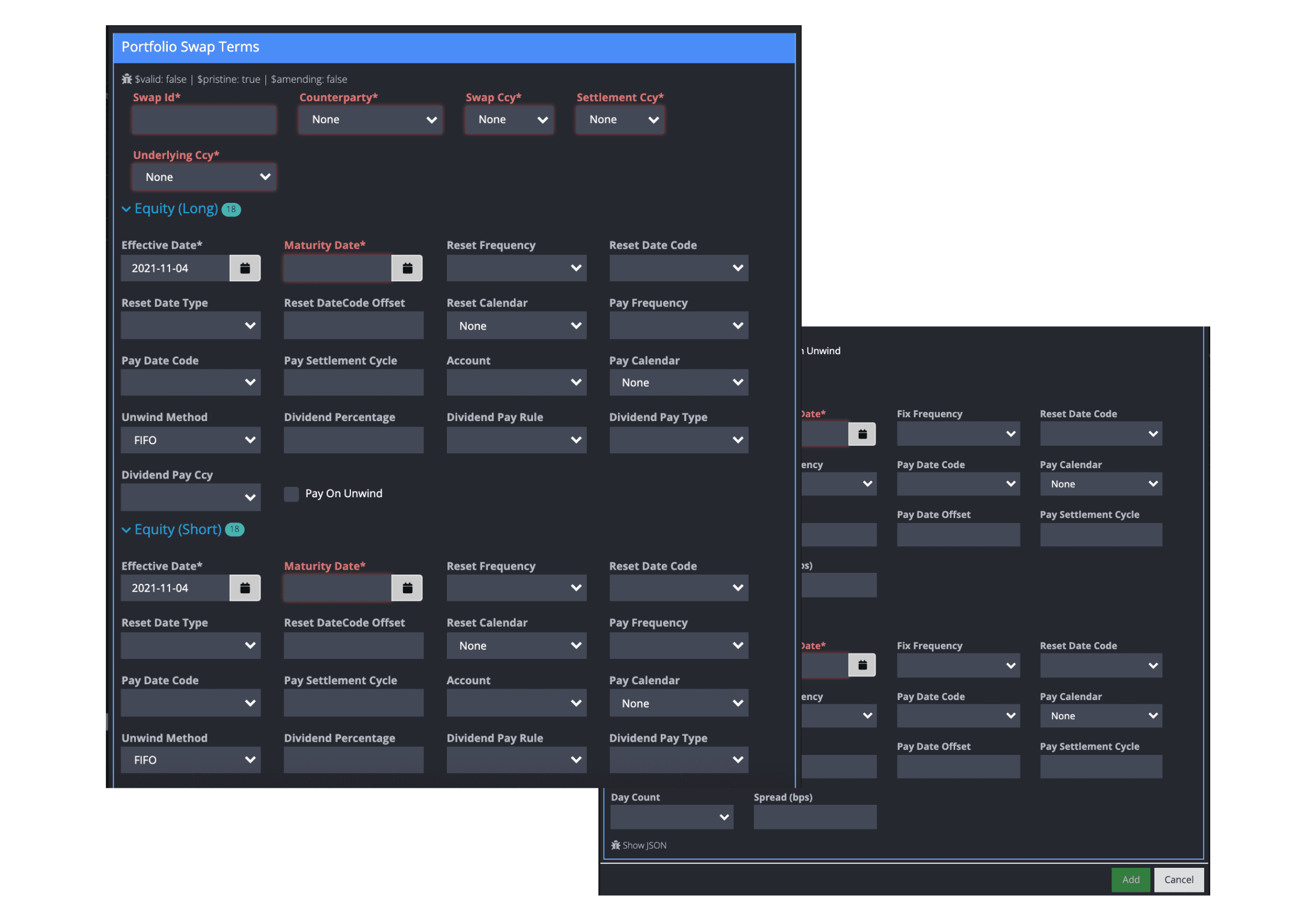

Swap terms

Custom fields

Ability to edit columns and pivot

Ability to add and edit swap terms without code

Comprehensive swap terms for any situation

Support file upload to batch create swap terms

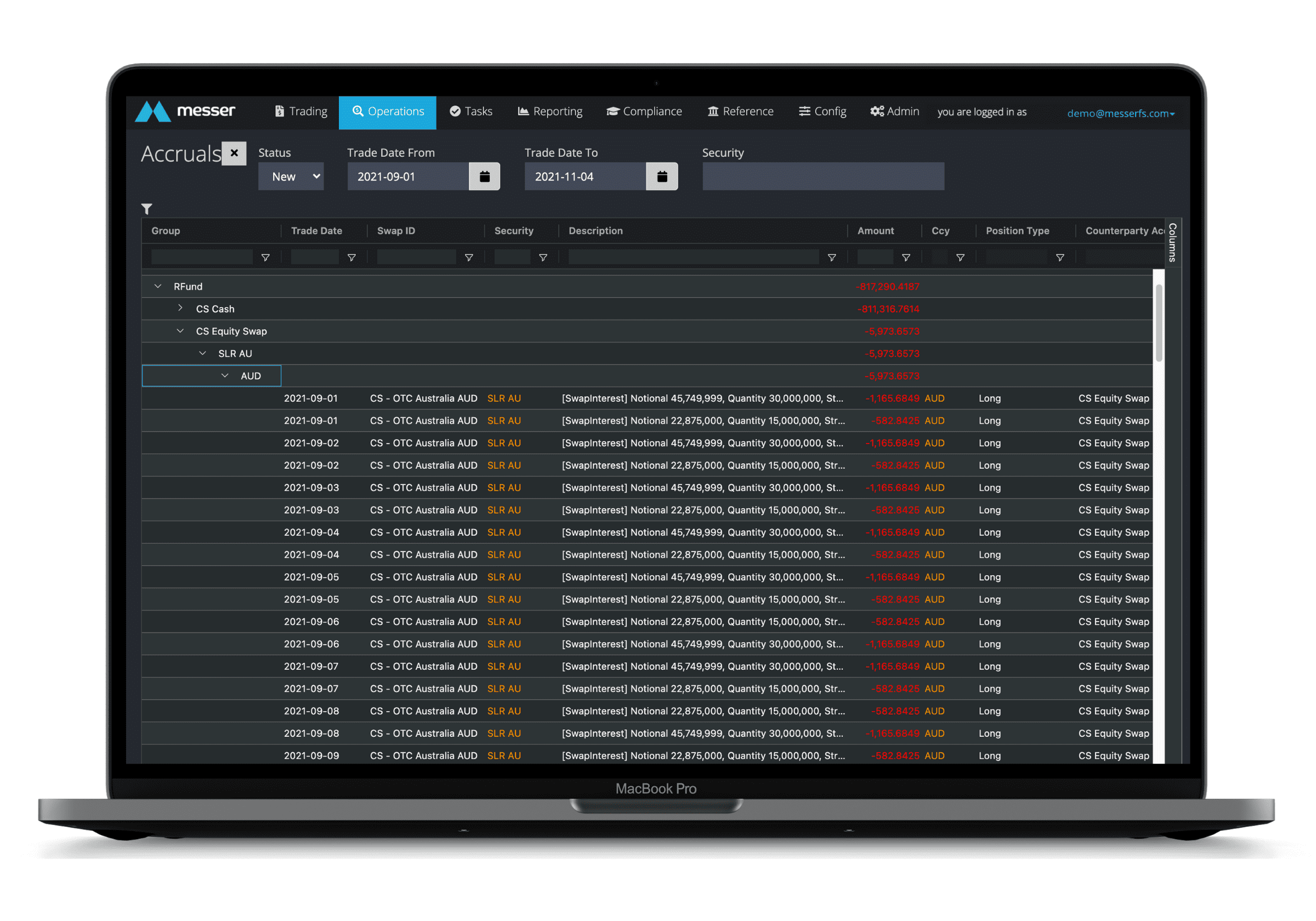

Accruals

Ability to drill down into trades and open lots

Group by fund, counterparty, security, currency and more!

Filter by time period

Speciality features

Compression workflow

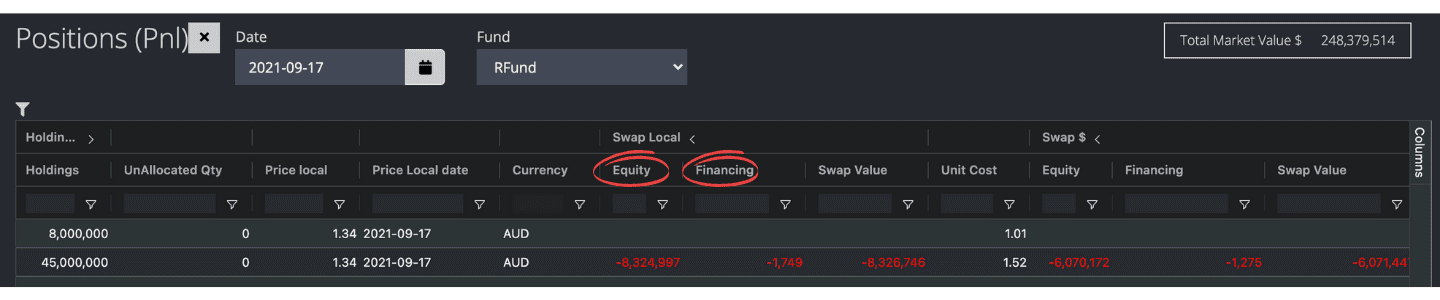

Separate equity and financing leg

Equity and financing leg of the total swap value can be displayed separately. This is to help clients to manage reconciliation with prime brokers who may send the equity and financing leg separately.