Please note that our website uses cookies. To learn more about our cookies and how we use them, please read our Privacy Policy.

Compliance (pre and post trade)

Safety before and after the trade

For hedge fund compliance is extremely important. Our modules below combine to form a robust compliance software. This service is included with Prodigy but is also available as a standalone workflow.

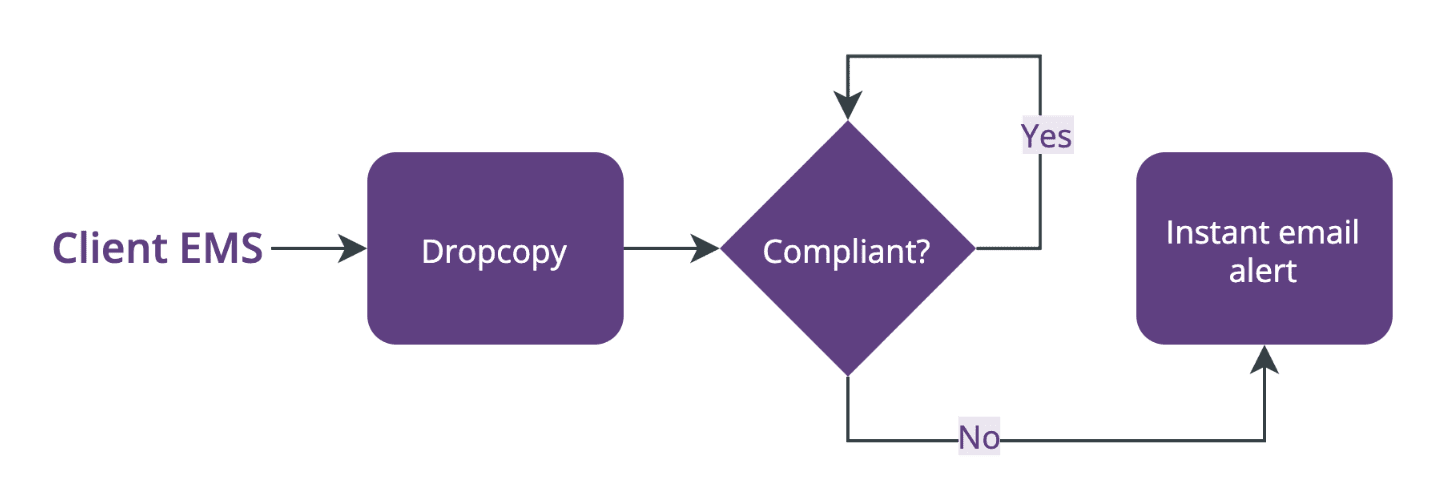

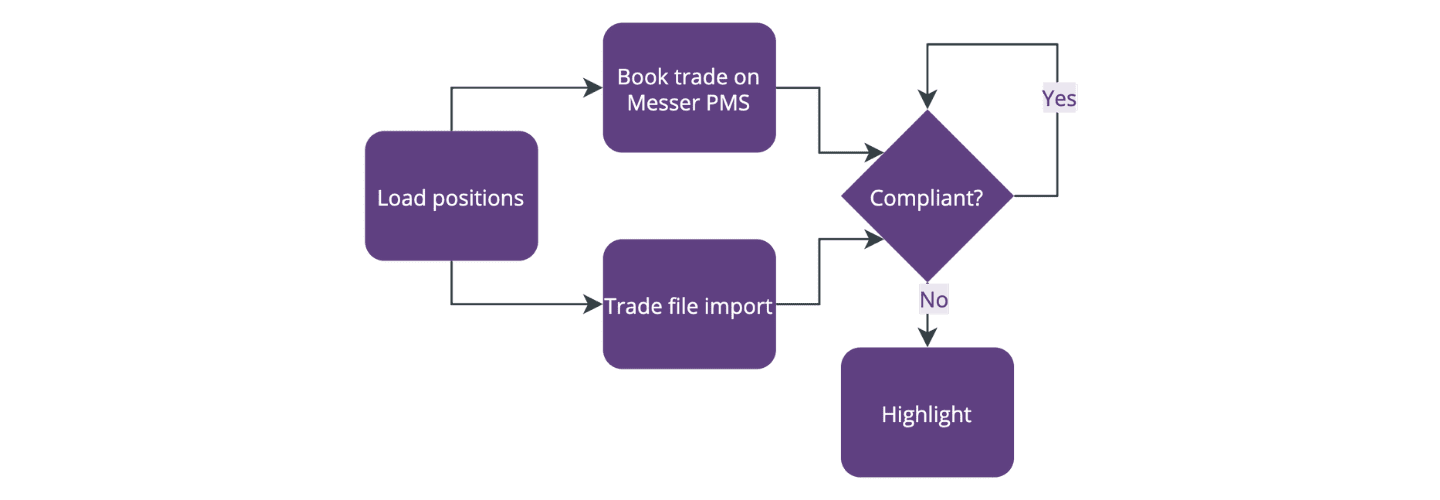

Pre-trade compliance

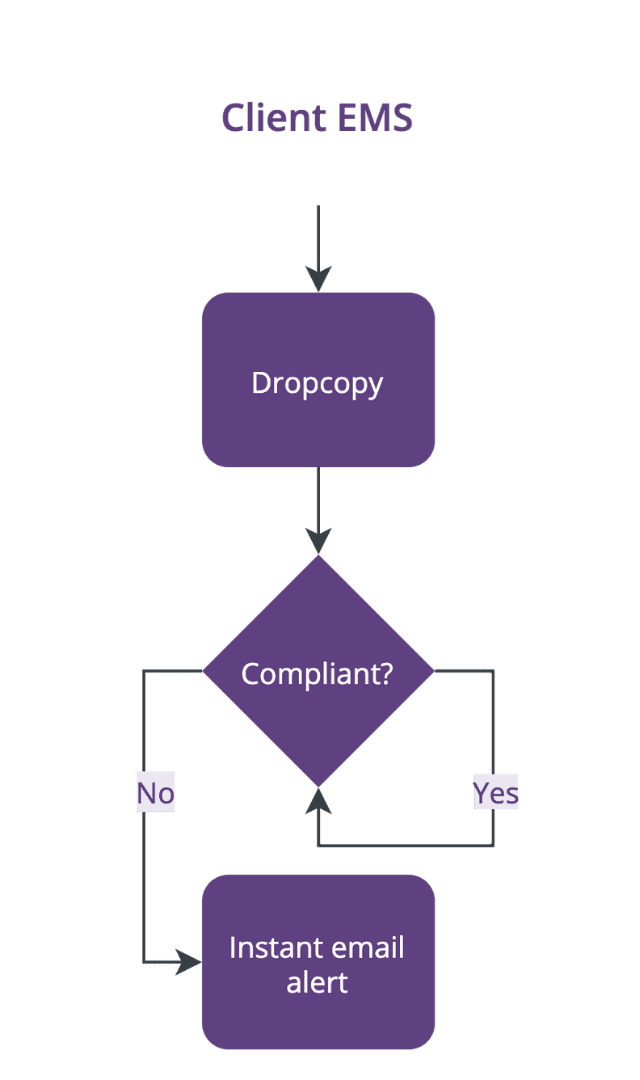

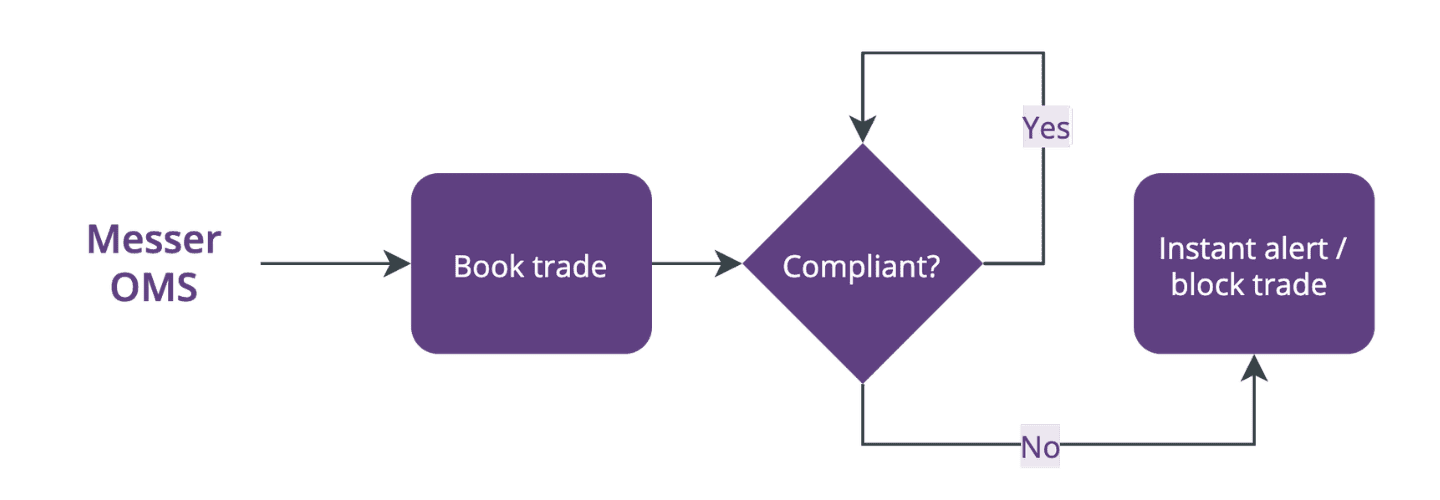

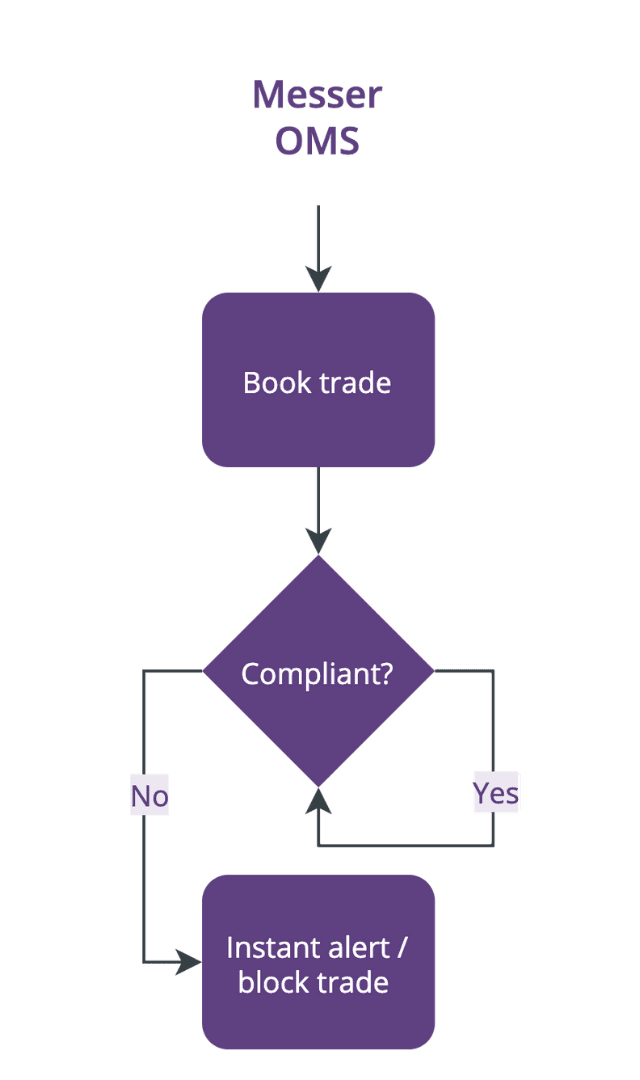

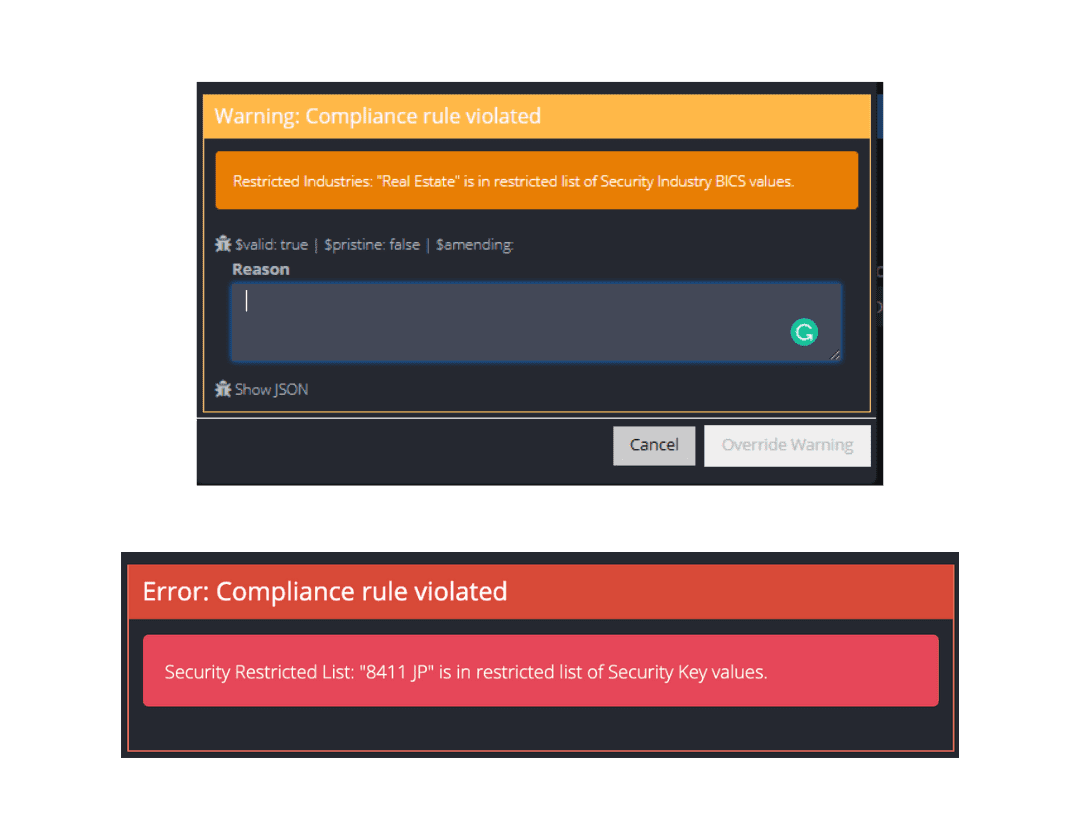

As the EMS does not take into account your current positions, your traders may trade restricted securities by accident. Booking trades on our OMS or through dropcopy workflow will leave time to cancel non-compliant orders. You can set up a white list, black list, grey list and applicable alerts.

Use case

EMS is not position-aware, and traders may trade restricted securities by accident.

How does it help?

You can book trades through our dropcopy workflow, leaving time to cancel orders if not compliant.

Or you can use on our OMS for the same outcome.

Key features

Pre-trade compliance

White list

Black list and applicable alerts

Grey list and applicable alerts

Easy-to-edit blotter

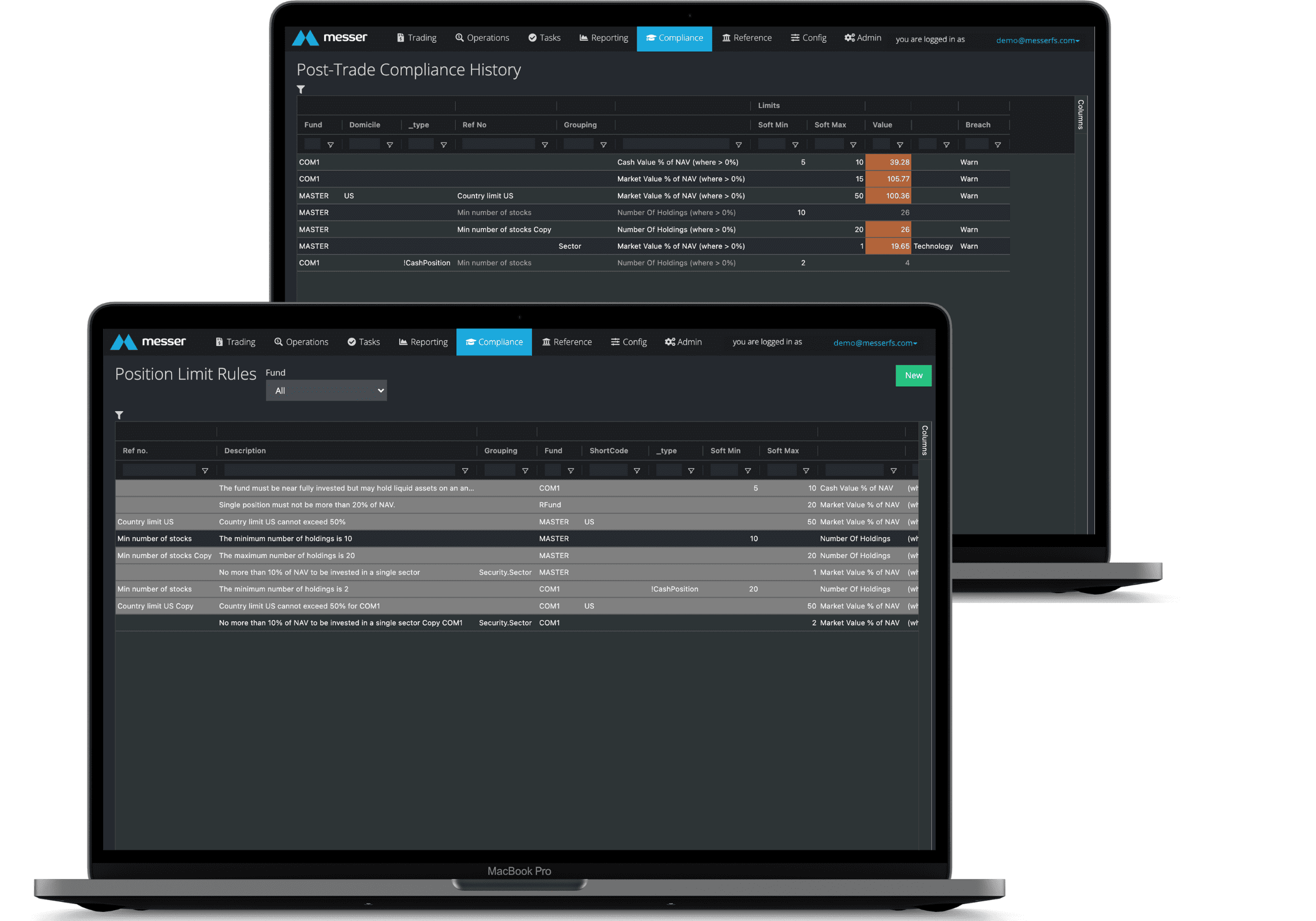

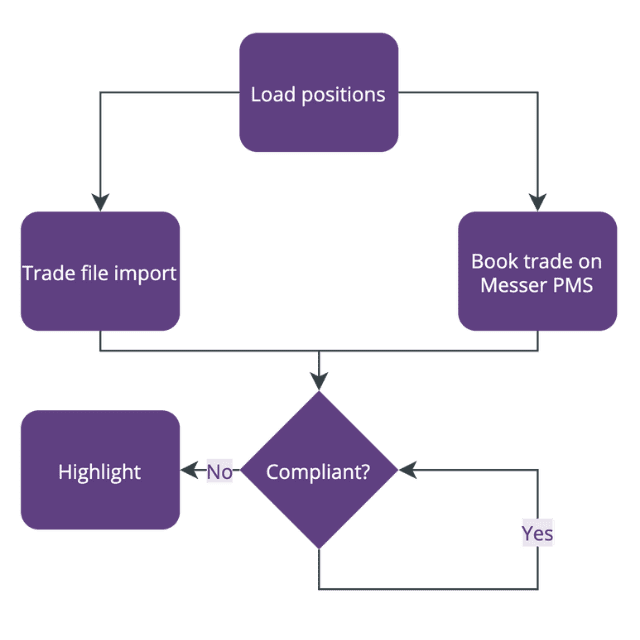

Post-trade compliance

As pre-trade compliance software does not take into account market moves during the day, positions may cease to be compliant as the day progresses. Messer post-trade compliance software checks intra-day and end-of-day if positions are still compliant taking into account market movement.

Use case

Pre-trade compliance software does not take into account market moves during the day.

How does it help?

Messer checks intra-day and end-of-day if positions are still compliant taking into account market movement.

Key features

Post-trade compliance

View results of any post trade compliance run

Design investor and regulatory reports

Ability to add and edit compliance rules